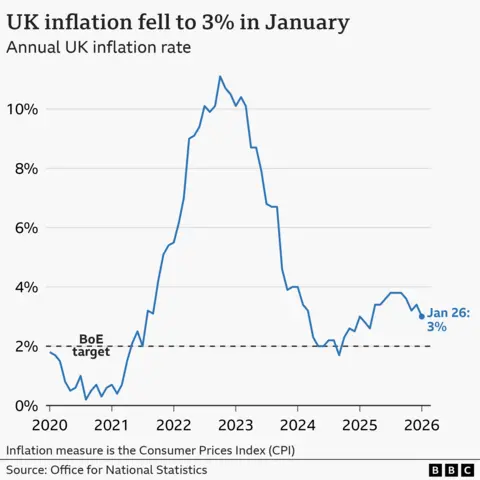

Lower food and fuel prices drive inflation down to 3%

Faarea MasudBusiness reporter

Getty Images

Getty ImagesThe UK’s inflation rate fell to 3% in January, down from 3.4% in December, driven by food, fuel and airfare prices.

Economists said the decrease raised the likelihood the Bank of England will cut interest rates at its March monetary policy meeting.

The Office for National Statistics (ONS) said the “marked” fall in January took inflation to its lowest rate since March 2025.

Although the rate of inflation has fallen, prices themselves are not coming down, but simply rising at a slower pace.

ONS chief economist Grant Fitzner said: “Inflation fell markedly in January to its lowest annual rate since March last year, driven partly by a decrease in petrol prices.

“Airfares were another downward driver this month with prices dropping back following the increase in December.”

But he added that lower costs for bread, cereals and meat were partially offset by the cost of hotel stays and takeaways.

Wednesday’s fall in inflation, coming after figures showed a slowdown in wage growth, makes it more likely the Bank of England will cut its key interest rate – currently set at 3.75%.

Economists are expecting inflation to fall further in the coming months, with the government cutting household energy bills from April. Forecasters Cornwall Insight predicted the measure would help lower the energy price cap for a typical household by £117 to £1,641 from April.

KPMG chief economist Yael Selfin said: “Given the favourable inflation outlook, the Bank is expected to cut interest rates three times this year, leaving interest rates at 3% by the end of 2026.”

The Institute for Chartered Accountants of England and Wales (ICAEW) said Wednesday’s figures show the struggle against soaring prices “took a decisive turn for the better in January”.

ICAEW economics director Suren Thiru said: “These figures make a spring interest rate cut look almost assured, though a lingering question among policymakers will be whether to pull the trigger in March or April as some may want slightly more evidence of easing inflation before reducing rates.”

Simon French, chief economist at Panmure Liberum, said there is now around an 80% chance the Bank of England will cut its interest rate in March.

Speaking to the BBC’s Today programme, he said the last time the Bank met, its vote to hold the rate at 3.75% was so finely split that it will take just a “little bit of additional evidence” of slowing inflation to “pip one of those members to shift their vote”.

He added that part of the reason inflation has fallen so slowly is Reeves’ 2024 Budget, in which she hiked employer National Insurance contributions, which French said has led to higher prices for consumers.

Chancellor Rachel Reeves welcomed the fall, adding that “cutting the cost of living is my number one priority”.

Reeves added: “Thanks to the choices we made at the budget we are bringing inflation down, with £150 off energy bills, a freeze in rail fares for the first time in 30 years and prescription fees frozen again.”

Inflation has steadily been decreasing toward the Bank of England’s 2% target.

But the Conservatives said it remains above that level “thanks to Labour’s choices”. Shadow Chancellor Sir Mel Stride said: “Families are still feeling the pinch because of Labour’s economic mismanagement.”

December’s sudden uptick was attributed to one-off seasonal factors such as flight costs over Christmas and an increase in tobacco tax announced in the Budget.

The biggest downward contributors in January, however, were transport, food and non-alcoholic beverages.

One baker told the BBC she would be grateful for a slowdown in prices, as the cost of her high-end ingredients surged – including luxury chocolate which has leaped by £7 a kilo in the past 18 months.

Gaya Vara says it now costs her just under £20 a kilo.

Gaya Vara

Gaya VaraGaya says that since she won’t switch to cheaper ingredients for her luxury bakery in London, she has so far been absorbing the price rises, which has led to lower profits.

Household finances were also helped out by the January sales, with the British Retail Consortium (BRC) pointing to “heavy discounting” on clothing, footwear and furniture.

The trade body pointed as well to drops in the prices of staples such as bread, cereals and rice.

BRC chief economist Harvir Dhillon said the improving picture “reflects intense competition between retailers, who continue to try and absorb higher costs wherever possible to keep prices down for customers”.

But it warned government policies such as higher minimum wages, rising national insurance contributions and the looming Employment Rights Act risk leaving retailers unable to keep a lid on future price increases.